BUILD BACKLINKS WEBSITE - BOOST LINK JUICE FAST

Get reviews + referrals you deserve:

Never miss a review to boost business and rank on Google.

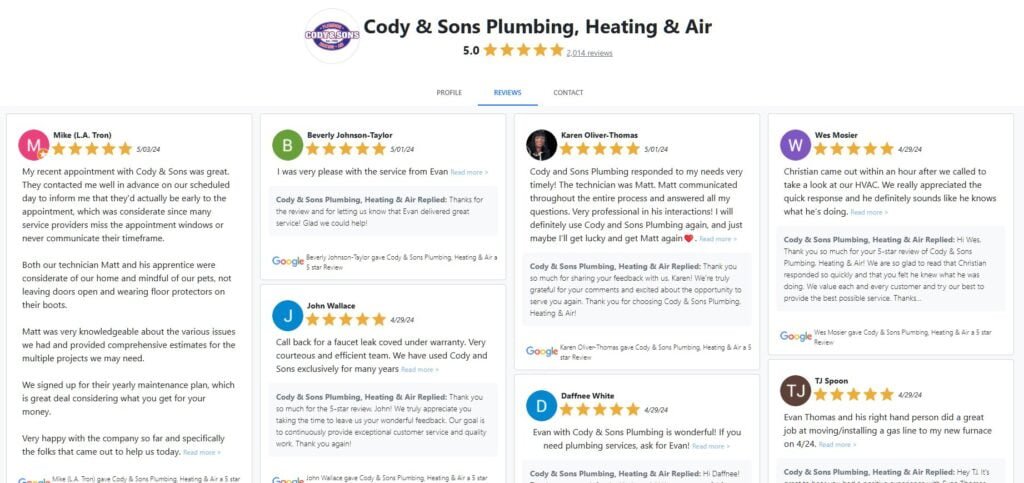

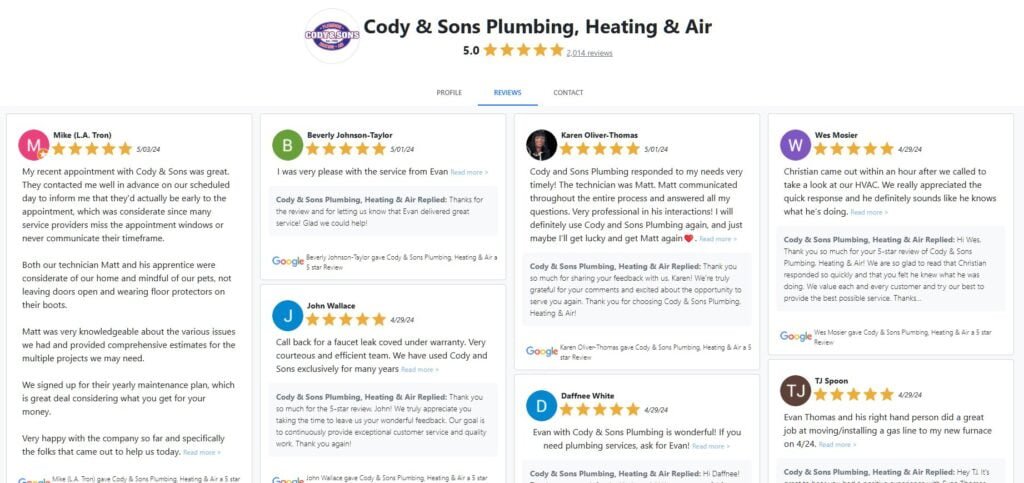

Customer Testimonial Examples

Image Courtesy of Cody & Sons Plumbing.

Image Courtesy of Cody & Sons Plumbing.